A reader asks:

Investors have been concerned about stock market concentration for years now. The S&P 500 keeps getting more and more concentrated but the biggest stocks also have the fundamentals to back it up. How does this resolve itself? Or do you think a more concentrated stock market is the new normal?

Concentration has been top of mind for many investors for some time now.

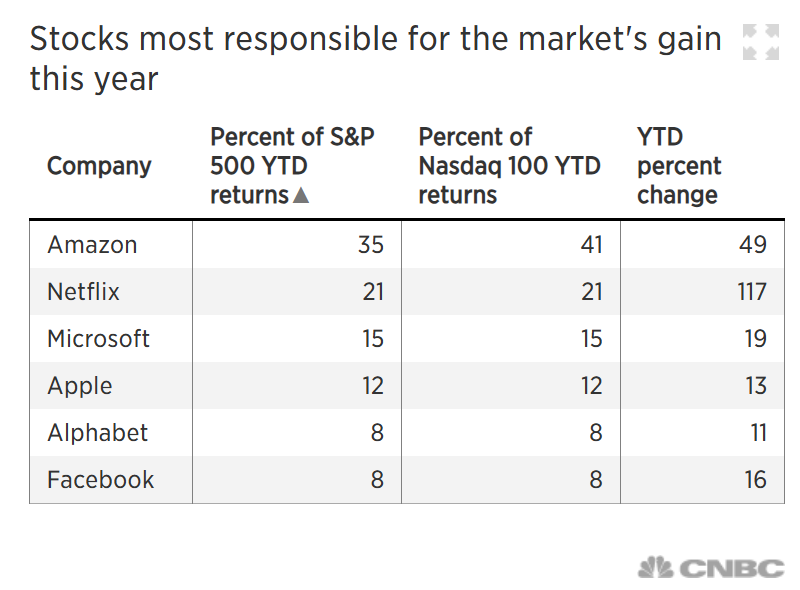

I first wrote about this topic all the way back in the summer of 2018. In that piece I referenced this story from CNBC:

Look at the companies they listed in terms of concentrated gains that year:

Those names look familiar. The only big difference is that today you can swap out Nvidia for Netflix.1 Investors were worried about concentration of tech stocks back then and they’re still worried today.

What if this is just the new normal for a while?

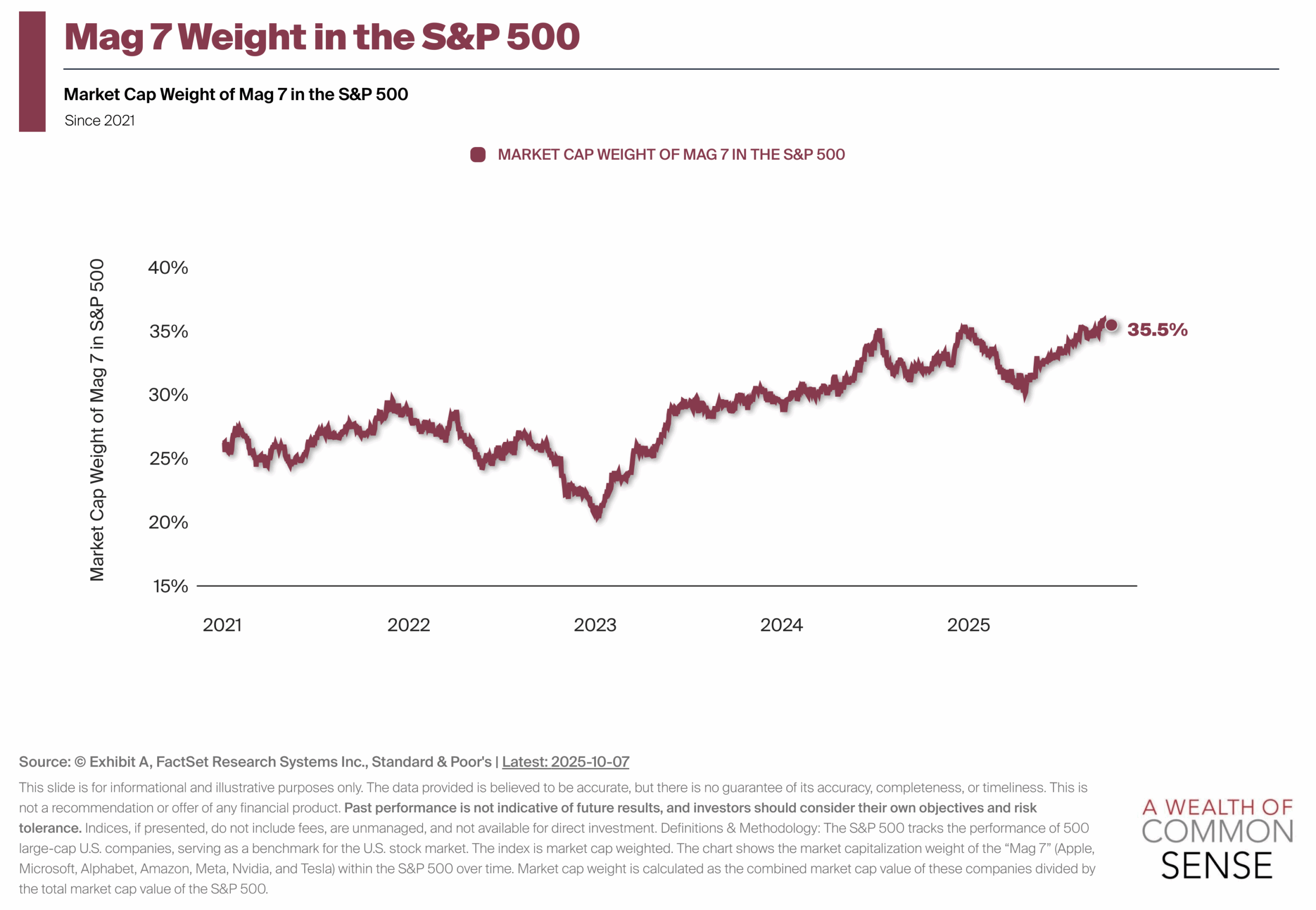

The Mag 7 continues to swallow the stock market:

Of course, the bigger these companies get, the more of an outsized impact they have on stock market returns.

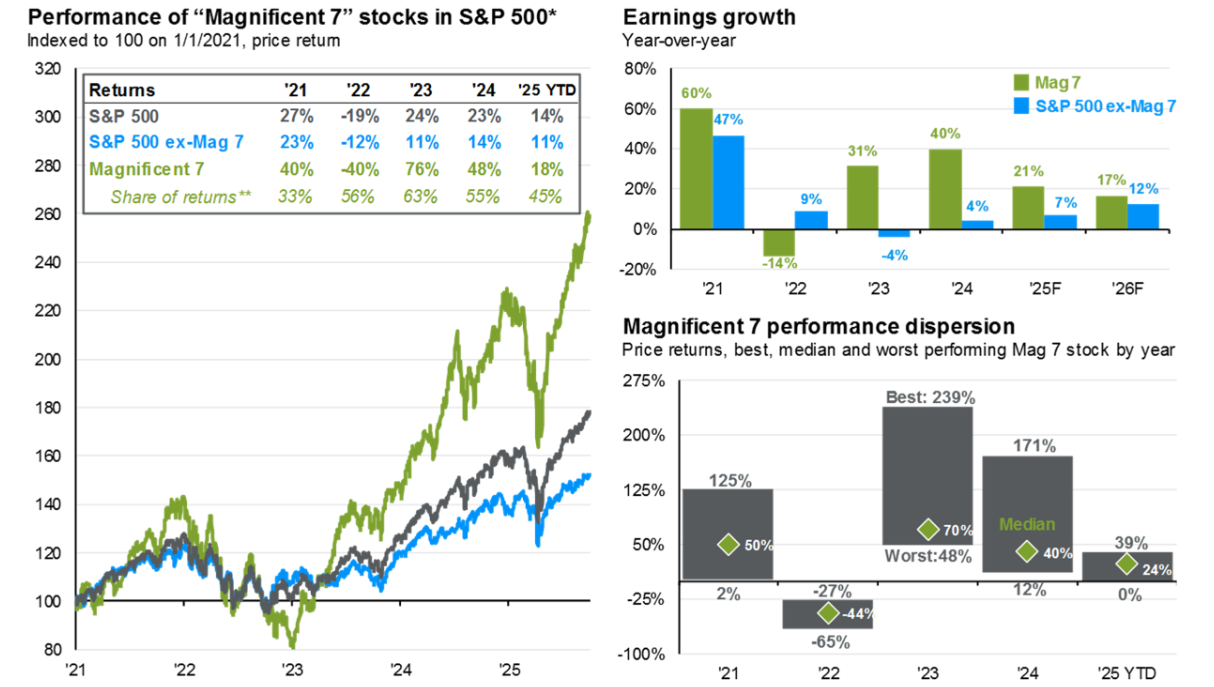

Here’s a good one from JP Morgan showing the contribution of the Mag 7 on performance and fundamentals:

The share of returns and earnings growth in the hands of a few companies feels unlike anything we’ve ever seen.

So how does this end?

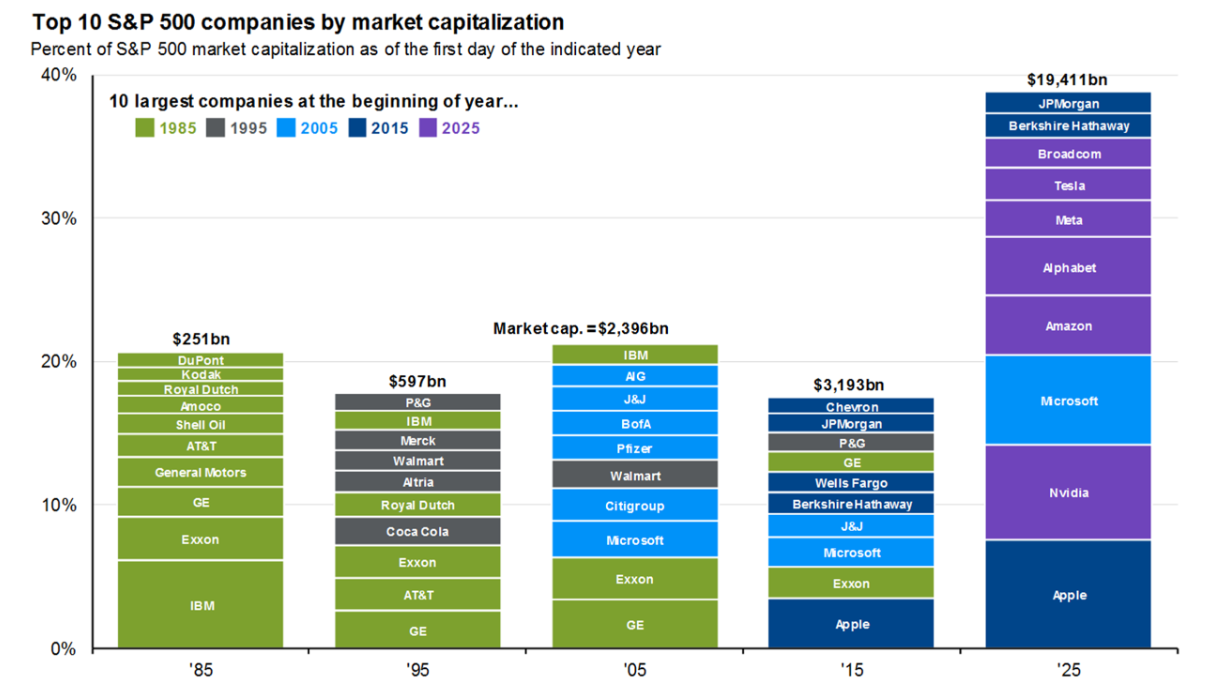

JP Morgan has another good one that shows the changes to the names in the top 10 stocks every 10 years going back to the mid-1980s:

Microsoft is the only member of the current top 10 names that was also there in 2005. Turnover is the norm for the big names even though there are some stocks that stay there for many years. The turnover rate is approximately 30-40%, or 3-4 names, every 5-10 years over the past 50 years.

That’s one way this thing could play out. We could see some of these big stocks falter or new entrants that take their place. We could also see the AI bubble pop in the years ahead which could do some damage to these large tech stocks.

But that doesn’t necessarily mean market concentration would automatically go away.

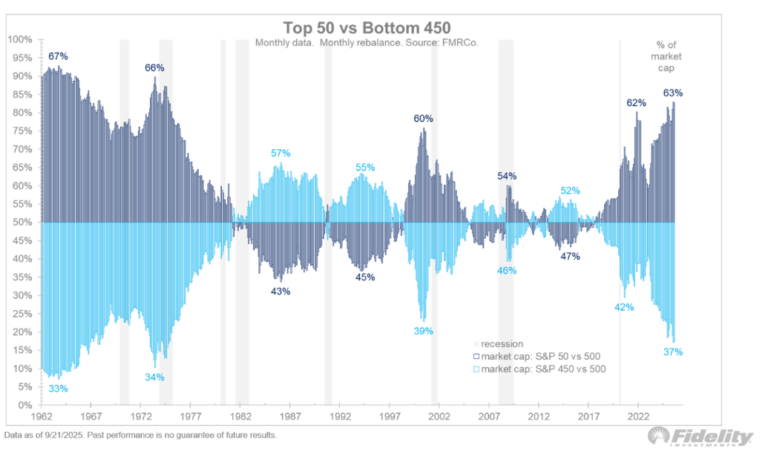

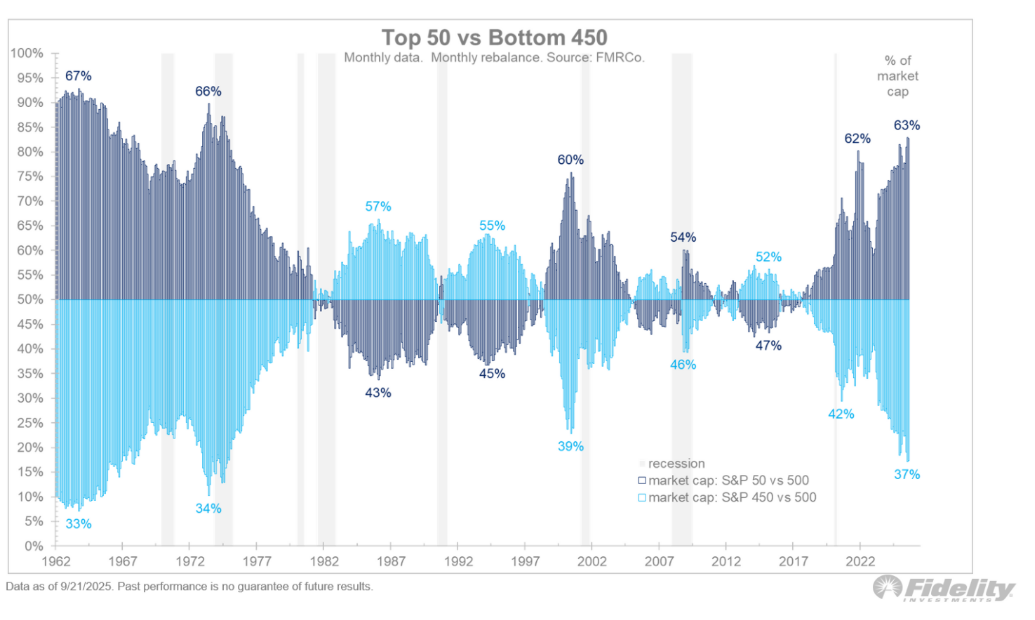

Jurrien Timmer has this great chart that looks at the weights of the 50 biggest stocks in the S&P 500 along with the other 450 names going back to the early-1960s:

He explains:

It’s worth remembering that while the top-heavy concentration during the late 1990’s was quickly reversed in the early 2000’s, during the 1950’s and 1960’s the market remained top-heavy for many years before excessive valuations finally took their toll. This could take some time.

Concentration did get wrung out of the stock market following the dot-com bust but there was an extended period throughout the 1960s and 1970s where the biggest stocks dominated.

There is reason to believe we’re now in a new normal of stock market concentration at the top for some time.

The big tech stocks are so entrenched in our lives that the government wants nothing to do with breaking them up. And anytime a new competitor emerges these corportations use their war chests of cash to buy up the competition.

These companies now have massive moats around their businesses, high profit margins, and produce insanely high cash flows.

I’m not saying these stocks will outperform forever. They won’t. And some of them will certainly fall out of the top 10.

But don’t be surprised if we’ve entered a new era where the stock market remains concentrated at the top.

Wealth inequality in the stock market might be here to stay.

Jurrien joined us on Ask the Compound this week to help answer this question:

We also covered questions about why the stock market isn’t concerned about a slowing labor market, why international stocks are outperforming, why gold is up 50% this year and how the AI boom will end.

Further Reading:

Concentration in the Stock Market

1Netflix is just outside the top 10. As of the latest data it’s the 13th biggest stock by market cap in the S&P 500.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.