Today’s Animal Spirits is brought to you by Betterment Advisor Solutions and Vanguard:

This episode is sponsored by Betterment Advisor Solutions. Grow your RIA, your way by visiting: https://Betterment.com/advisors

This episode is sponsored by Vanguard. Learn more at: https://www.vanguard.com/audio

On today’s show, we discuss:

Listen here:

Charts:

Recommendations:

Tweets/Bluesky:

According to Challenger, the pace of hiring has fallen off a cliff. Weakest September for job creation since 2011. https://t.co/ebwkUkVFbn pic.twitter.com/HYumFHSphD

— Joe Weisenthal (@TheStalwart) October 2, 2025

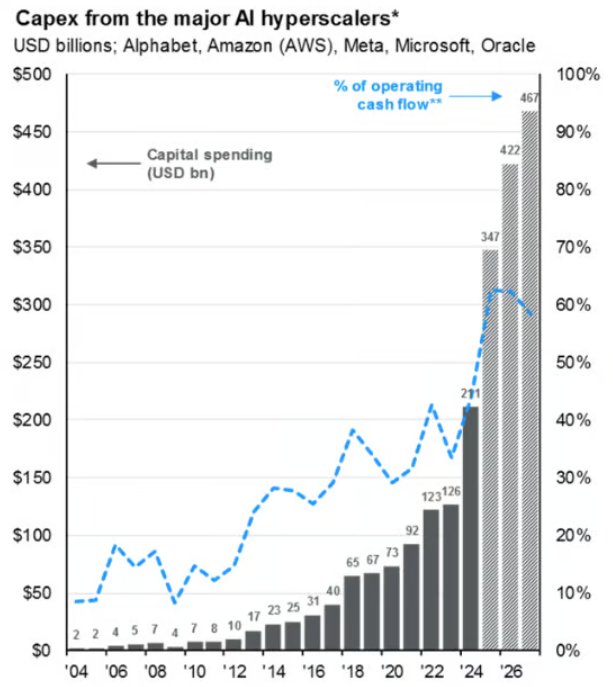

This is a surface level take.

Most AI capex (i.e. from hyperscalers) is spending against current demand with revenue coming in immediately.

Let’s dig a little deeper.

— John Shedletsky (@Shedletsky) October 3, 2025

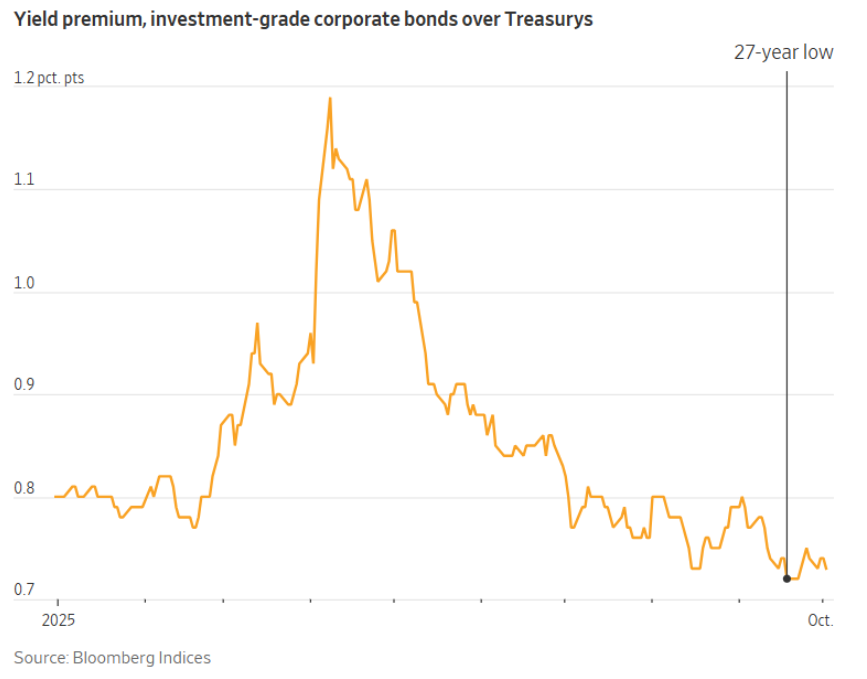

Returns have been basically straight up since the Liberation Day lows. The Nasdaq has not seen even a 3% correction since then. The streak is now at 115 market days, the seventh longest going back to 1971. For comparison, the index has averaged a 3% correction every 20 days. pic.twitter.com/9Mapfdi9FO

— Rob Anderson (@_rob_anderson) October 3, 2025

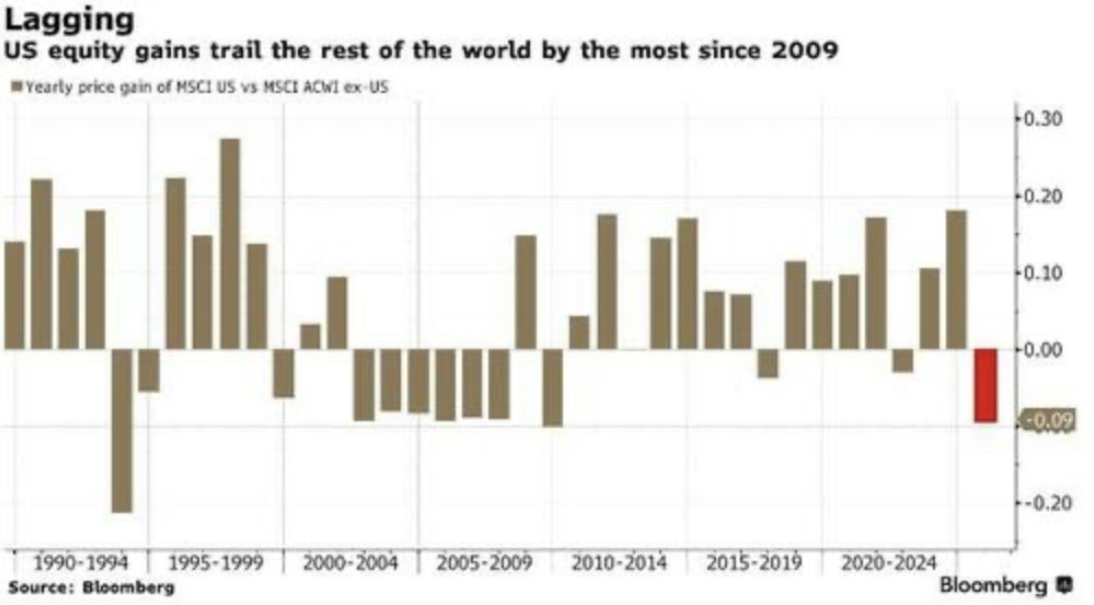

For international equities the valuation question doesn’t pose much of a dilemma. The MSCI EAFE index not only has a reasonable valuation of 16.5x expected earnings, but its payout growth (as well as payout ratio) has become quite competitive with the US. International… pic.twitter.com/37F0jIaUIo

— Jurrien Timmer (@TimmerFidelity) October 1, 2025

— Martin Shkreli (@MartinShkreli) October 3, 2025

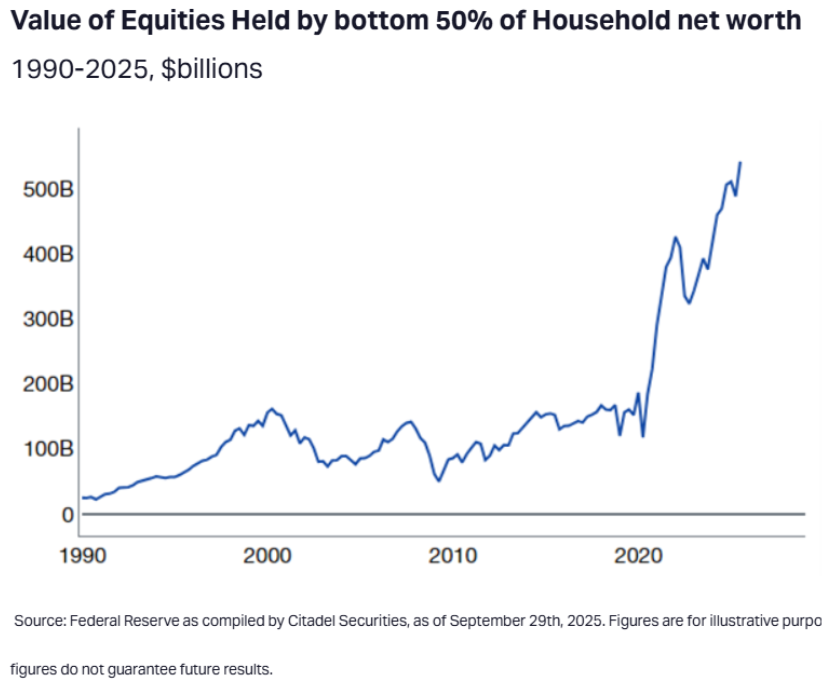

Everyone is a genius in a bull mkt pic.twitter.com/3kNs3Vnjmr

— TTI (@TikTokInvestors) October 5, 2025

There are now 19 stocks in the Russell 3,000 up more than 400% since the 4/8 Tariff Crash low. pic.twitter.com/NwVEFv5fwC

— Bespoke (@bespokeinvest) October 3, 2025

— modest proposal (@modestproposal1) September 30, 2025

Paul Tudor Jones just said on CNBC that he thinks the ingredients are in place for massive stock price increases before the bull market tops out

“My guess is that I think all the ingredients are in place for some kind of a blow off” … “History rhymes a lot, so I would think… pic.twitter.com/FkZNlFBOXk

— Evan (@StockMKTNewz) October 6, 2025

There is a bubble in financial news stories that lead w/a picture of a bubble

Saw all of these in stories just in the past week pic.twitter.com/udr7ya0ZmK

— Ben Carlson (@awealthofcs) October 6, 2025

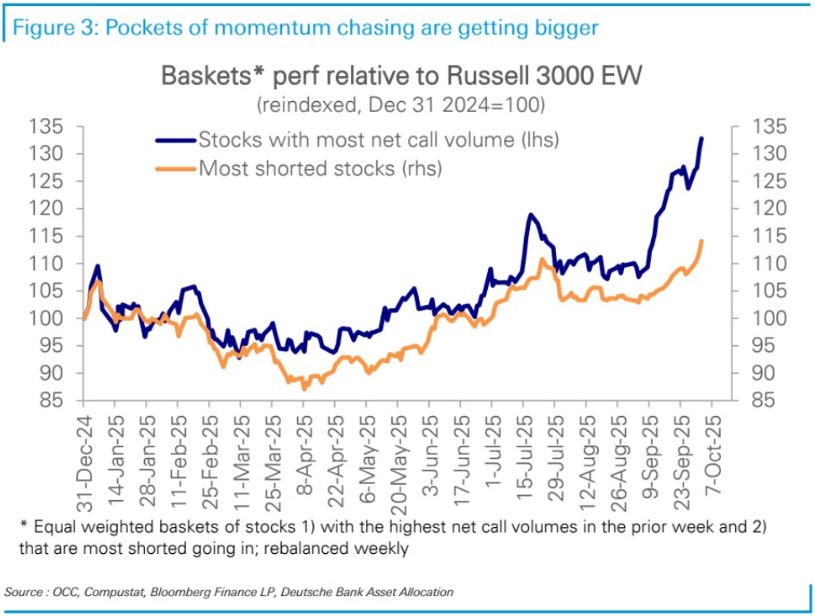

The last 6 months have been all about low quality.

The junikier the better! @AugurInfinity

Stocks of tech companies that are not profitable have more than doubled since the April 8 low.https://t.co/NUEbg6YUF8 pic.twitter.com/GeuVCuiDJX

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) October 3, 2025

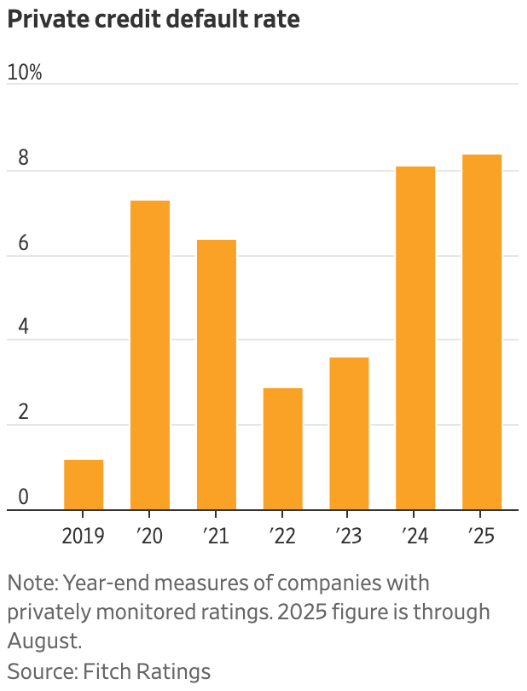

I don’t own any BDC’s, but the BDC squad is flashing a warning sign. All names in the toilet this year, and a lot of the sponsored BDC’s like HSBD, CGBD, OBDC are absolutely tanking. pic.twitter.com/wEEC9HHipd

— Cluseau Investments (@blondesnmoney) September 30, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.